Best Bank Of America Credit Cards 2024

Bank of America offers diverse credit cards with rewards tailored to spending habits, user-friendly apps, educational resources, and nationwide support. Discover the best fit for your needs.

Bank of America offers a diverse range of credit cards tailored to specific spending habits and lifestyles. These cards provide various rewards programs, including cashback on everyday purchases and rewards for travel, dining, and airfare.

With customizable features, cardholders can maximize benefits and enjoy seamless account management through user-friendly mobile apps and online platforms. Bank of America prioritizes customer satisfaction with transparent financial tools, educational resources, and incentives for responsible credit management.

Their extensive ATM and branch network ensures convenient access and support for customers nationwide. Discover the unique features, rewards structures, and benefits of Bank of America credit cards, whether you’re an experienced user or starting your financial journey.

Best Bank Of America Credit Cards 2024

| Credit Card | Rating | Best For… | Annual Fee | Interest Rates | Rewards Rate | Perks |

|---|---|---|---|---|---|---|

| Alaska Airlines Visa Credit Card | 4 | Alaska Airlines frequent flyers | $95 | 19.99% to 27.99% | Unlimited 1x to 3x miles | Companion fare |

| BankAmericard Credit Card | 3.5 | Balance transfers | None | 15.99% to 25.99% on purchases and balance transfers | None | Free FICO score |

| Bank of America Business Advantage Customized Cash Rewards Mastercard Credit Card | 4.3 | Business expenses | None | 18.24% to 28.24% | 1% to 3% cash back | Customizable rewards category |

| Bank of America Customized Cash Rewards Credit Card for Students | 4.1 | Overall rewards for students | None | 17.99% to 27.99% | 1% to 3% cash back | Customizable cash back category |

| Bank of America Premium Rewards Elite Credit Card | 3.2 | Airline lounge access | $550 | 19.99% to 26.99% | Unlimited 1.5x to 2x points | VIP airport lounge access worldwide |

| Bank of America Travel Rewards Credit Card for Students | 4.2 | Travel rewards for students | None | 17.99% to 27.99% on purchases and balance transfers | Unlimited 1.5x points | Unlimited points |

| Bank of America Unlimited Cash Rewards Credit Card | 3.3 | Straightforward cash back | None | 17.99% to 27.99% | Unlimited 1.5% cash back | Option to earn more cash back as a Preferred Rewards member |

| Bank of America Unlimited Cash Rewards Secured Credit Card | 4.5 | Secured credit card | None | 27.99% variable | Unlimited 1.5% cash back | Unlimited cash back is a strong offer for a secured card |

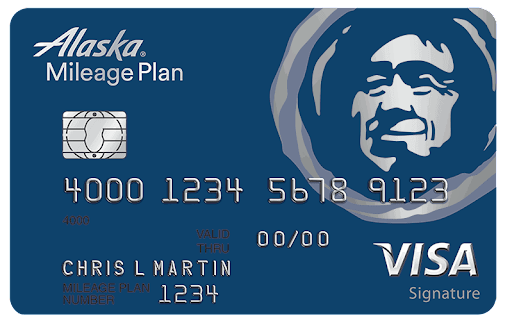

Alaska Airlines Visa Credit Card

Show More Details

The Alaska Airlines Visa Credit Card is ideal for people that frequently fly with Alaska Airlines. With a low annual fee and immense value on Alaska Airlines purchases, it’s worth it if you fly often.

Rewards:

- Unlimited 3x miles per $1 spent on eligible Alaska Airlines purchases

- Unlimited 2x miles for every $1 spent on eligible gas, cable, streaming services, and ride share purchases

- Unlimited 1x miles for every $1 spent on everything else

Miles can be redeemed with over 20 global airline partners. If you have an eligible Bank of America account, you’ll also receive a 10% rewards bonus on all miles earned from card purchases.

Pros

- No foreign transaction fee

- Reasonable annual fee given the value

Cons

- Alaska Airlines has limited flights to the east coast

- Companion ticket is limited to Alaska Airlines flights only

Additional Details

This card comes with a few extra perks, ideal for travelers:

- Free checked bag on Alaska Airlines

- Priority boarding for you and up to six guests on the same reservation when you purchase flight tickets with your card

- An annual companion fare after spending $6,000 or more in the prior anniversary year

- 20% rebate for all in-flight purchases

- No foreign transaction fees

BankAmericard Credit Card

Show More Details

The BankAmericard Credit Card doesn’t offer rewards or a welcome bonus, but its 0% APR offer makes it compelling for balance transfers.

Rewards: None

Pros

- No annual fee

- No penalty APR

Cons

- No welcome bonus

- No rewards

- 3% foreign transaction fee

Additional Details

This card doesn’t come with many added bonuses, which is a drawback. However, it does come with free FICO score monitoring, online banking, and mobile banking.

Bank of America Business Advantage Customized Cash Rewards Mastercard Credit Card

Show More Details

The Business Advantage Customized Cash Rewards Mastercard is ideal for business owners that’d prefer a card with no annual fee. This card has surprisingly good rewards given the lack of an annual fee.

Rewards:

- 3% cash back in the category of your choice (on the first $50,000 of purchases; 1% thereafter)

- 2% cash back on dining (on the first $50,000 of purchases; 1% thereafter)

- Unlimited 1% cash back on everything else

You can redeem points for a statement credit, as cash in a Bank of America checking or savings account, or as a check mailed to you.

Pros

- No annual fee

- Customizable rewards category

- 0% APR offer for the first nine billing cycles

Cons

- 3% foreign transaction fee

Additional Details

This card comes with purchase protection and extended warranty options.

Bank of America Customized Cash Rewards Credit Card for Students

Show More Details

Despite not having an annual fee, this card has impressive rewards. It does, however, have a 3% foreign transaction fee, so it’s best for students planning to study abroad to stay away from this one.

Rewards:

- 3% cash back in the category of your choice

- 2% cash back at grocery stores and wholesale clubs

- 1% cash back on everything else

Bonus earnings are limited to the first $2,500 in combined purchases per quarter. After that, you’ll earn 1% cash back.

Pros

- Solid cash back

- No annual fee

- Welcome bonus is easy to earn

Cons

- 3% foreign transaction fee

- High APR

Additional Details

This card comes with an optional 0% introductory APR for 18 billing cycles for both purchases and any balance transfers made in the first 60 days. This makes it ideal for students seeking a balance transfer as well.

Bank of America Premium Rewards Elite Credit Card

Show More Details

The Premium Rewards Elite Credit Card is ideal for frequent flyers that want VIP lounge access worldwide. While it does lack travel transfer partners, it comes with a simple rewards structure, a reasonable annual fee given the value, and a variety of travel-related bonuses.

Rewards:

- Unlimited 2x points per dollar on travel and dining

- Unlimited 1.5x points on everything else

Pros

- Simple rewards structure

- Airline lounge access included

- No foreign transaction fee

Cons

- No travel transfer partners

Additional Details

This card comes with a few travel-related bonuses:

- Up to $200 in airline incidental statement credits

- Up to $150 in lifestyle statement credits for qualifying purchases

- 20% discount on airfare when redeeming points through the Bank of America Travel Center

- 12-month Priority Pass Select membership for VIP airport lounge access worldwide

Bank of America Travel Rewards Credit Card for Students

Show More Details

The Travel Rewards Credit Card for Students is ideal for students on the go. Its simple rewards structure means you don’t need to worry about tracking spending categories. Plus, it has no foreign transaction fee, making it perfect for students studying abroad.

Rewards:

- Unlimited 1.5x points per $1 spent on all purchases

Points can be redeemed to pay for travel or dining purchases, such as flights, hotels, baggage fees, and restaurants.

Pros

- No annual fee

- No foreign transaction fee

- Simple rewards structure

Cons

- High balance transfer fee

- High APR

- Some competing cards have strong rewards options

Additional Details

This card offers an introductory 0% APR for 18 billing cycles, which is ideal for students seeking a balance transfer as well.

Bank of America Unlimited Cash Rewards Credit Card

Show More Details

The Unlimited Cash Rewards Credit Card doesn’t have some of the bells and whistles of its competitors, but it’s a strong option if you don’t want to track cash back categories or pay an annual fee.

Rewards:

- Unlimited 1.5% cash back on all purchases

Pros

- Simple cash back rewards structure

- No annual fee

Cons

- Some competing cards offer stronger rewards

- 3% foreign transaction fee

Additional Details

If you’re a Preferred Rewards member — which includes opening a Bank of America checking account and having a specific daily balance — you can earn up to 25% to 75% more cash back on every purchase.

Bank of America Unlimited Cash Rewards Secured Credit Card

Show More Details

The Unlimited Cash Rewards Secured Credit Card is ideal if you need a secured card. Unlike some competing cards, it offers a solid rewards program with unlimited 1.5% cash back on everything.

Rewards:

- Unlimited 1.5% cash back on all purchases

Pros

- No annual fee

- You don’t need good credit to qualify

- Simple rewards structure

- Optional graduation to an unsecured card

- Free FICO score

Cons

- No welcome bonus

- High APR

- 3% foreign transaction fee

Additional Details

To open this card, you’ll need a minimum deposit of $200, which will later become your total credit line. After using the card for a period of time, you may have the option to graduate to an unsecured card.

Frequently Asked Questions (FAQs)

What Kind Of Rewards I Get With Bank Of America Credit Cards?

Bank of America offers cash back, points, and travel rewards depending on the card. Preferred Rewards members can earn even more.

What Are The Annual Fees For Bank Of America Credit Cards?

Some cards have no annual fee, while others do. Check details on the Bank of America site or comparison sites.

Does Bank Of America Offer Balance Transfer Credit Cards?

Yes, Bank of America offers cards with balance transfer capabilities. Always compare terms and conditions with other cards.

Can I Get A Bank Of America Credit Card With Bad Credit?

Bank of America offers secured credit cards for those building or rebuilding credit.

How Do I Redeem Rewards On Bank Of America Credit Cards?

Rewards can usually be redeemed for statement credits, checks, deposits into a Bank of America account, or for gift cards and purchases at the Bank of America Travel Center.

Does Bank Of America Offer A Student Credit Card?

Yes, Bank of America has cards for students like the Bank of America Cash Rewards for Students.

Can I Use Bank Of America Credit Cards Internationally?

Yes, but keep in mind that some cards may charge foreign transaction fees.